Leaflet and Useful Links

ONE

Investment Solution

Ready-made and low cost

Leaflet and Useful Links

If one or more of the specified fund switching instruction(s) is / are being processed on the annual date of de-risking, the annual de-risking will only take place on the next dealing day upon the completion of these instructions where necessary. You should note that the annual de-risking may be postponed as a result.

| Name of Notice | Target | Send Out Time |

|---|---|---|

| DIS Pre-Implementation Notice (“DPN”) & Important Note | All members | December 2016 to January 2017 |

| DIS Re-Investment Notice ("DRN") | Relevant members | 20 April 2017 |

Members who HAVE NOT given any investment instruction would receive the "DIS Re-investment Notice" ("DRN"). If the relevant members do not agree to accept the new arrangement, they need to opt-out by replying to BCT. If no reply is given within 42 days of the date of the "DIS Re-investment Notice", any MPF assets already accumulated, future contributions and MPFs transferred from another scheme in the future would be invested in accordance with the DIS.

Relevant members have until "Due Date" (i.e. 42 days after the date of the DRN) to give instruction in response to the DRN. If they want to stay invested in the original default fund, they must respond to the DRN through the following "authorized" channels, so that relevant instruction is received by us before the following cut-off times on the Due Date. Channels other than those set out below are not authorized for DIS purposes and submitting the instruction through unauthorized channels (e.g. via e-mail, intermediaries or bank branches) is generally not acceptable (although the trustee may, on a case basis, choose to accept and process such instruction based on the actual time of receipt by the trustee).

| Authorized Channels for DIS Purpose | Cut-off Time on the Due Date |

|---|---|

| By post / In person (for instruction given by way of the attached Option 2 Form) | 6:00 pm on the Due Date. Please make sure that sufficient time is allowed for postage (if applicable), so that the completed option 2 form can be received by Bank Consortium Trust Company Limited before the above cut-off time. |

| Fax (for instruction given by way of the attached Option 2 Form) | 23:59:59 pm on the Due Date |

| BCT website / BCT mobile apps (for instruction given via such website / apps) | 23:59:59 pm on the Due Date |

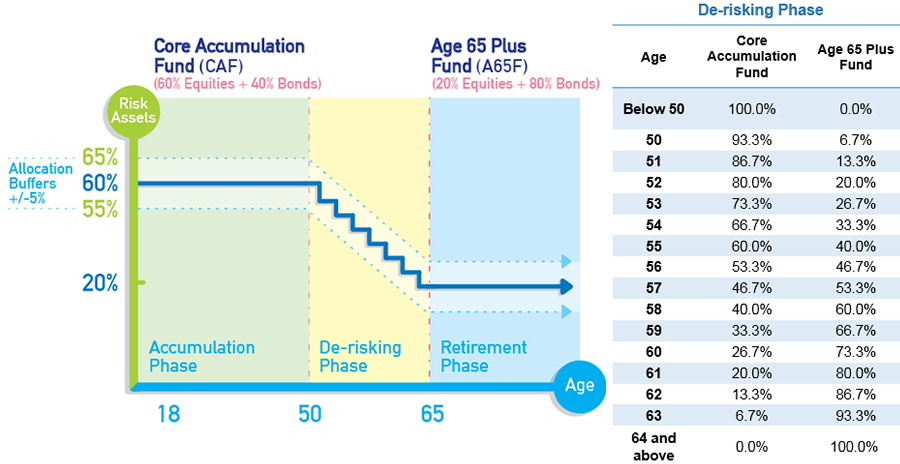

The Default Investment Strategy ("DIS") commenced on 1 April 2017. It is a ready-made and low cost investment strategy designed for MPF members who do not have time, or do not know how to make investment decisions. The DIS standardizes the default arrangements of the MPF schemes. In the new arrangement, the MPF benefits of members who do not give an investment instruction would be invested automatically according to the DIS. Members can also actively select the DIS or funds under the DIS if they find that the solution suits their own circumstances. You can know more about the key features of the DIS here.

Ready-made and low cost

As an MPF member approaches retirement age, the investment strategy will be progressively adjusted to reduce the proportion of higher risk assets. The age-based de-risking will be generally carried out on members' birthday.

| Active Investment Option | De-risking Applies |

|---|---|

| DIS (the strategy) | |

| Core Accumulation Fund Age 65 Plus Fund |

To know more about the DIS, please refer to the notices, MPF Scheme Brochure and other materials at our Download Zone.