To simplify the options for investment instruction and accommodate for the launch of the Default Investment Strategy, effective from 1 April 2017 ("Effective Date"), we will modify the options for investment mandate of transfer-in-assets ("Transfer-in Mandate").

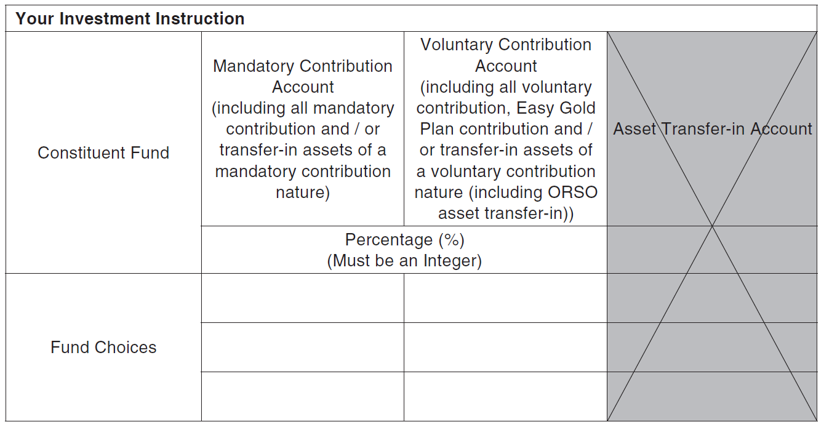

On the Effective Date, the column of "Transfer-in Mandate" will be removed from the relevant administration forms (namely, the "Member Enrolment Form" and the "Change of Investment Mandate for Future Contributions/ Fund Switching for Existing Balance Form") and the relevant sections relating to investment mandates from the web-environment (e.g. member website and mobile application) so that they will appear as below.

For more details, please read the relevant letter that is mailed to members (except members of personal accounts) with the 2016 "Member Benefit Statement".

Please be informed that, on the same day (1 April), change of investment instruction (including switching existing fund balance and change of investment mandate for future contributions and transfer-in-assets) and redemption of Easy Gold Plan through "Interactive Voice Response System" will be suspended. If you would like to change your investment portfolio, you can give instruction through our website www.bcthk.com, mobile application, or by form submission. If you would like to have redemption of your Easy Gold Plan, you can give instruction through our website www.bcthk.com, or by form submission.