| The Government will put in place two supporting measures to facilitate the transition. First, to assist employers to adapt to the policy change, the Government will introduce a 25-year refined subsidy scheme totalling $33.2 billion. Another supporting measure is the introduction of a Designated Savings Accounts (DSA) Scheme under which employers will be mandated to save up for meeting their future SP/LSP liabilities after the abolition. |

Employers’ share ratio details under the refined subsidy scheme are proposed.

For the first $500,000 of the total amount of SP/LSP payable by an employer in a year:

- There is a share ratio payable by an employer per employee for each year; and

- For the initial nine years, the maximum amount of SP/LSP (i.e. the “capped amount”) payable by an employer per employee is capped. If the shared amount payable by an employer exceeds the “capped amount”, the employer only needs to pay the “capped amount”. The rest of the amount of SP/LSP will be subsidised by the Government.

For the total amount of SP/LSP beyond the first $500,000:

- There is a share ratio payable by an employer per employee for each year from Year 1 to Year 12. No subsidy will be provided from Year 13 onwards.

| Year after the abolition |

Employer’s share per employee

(as % of SP/LSP payable) |

| |

First $500,000 of all SP/LSP paid by an employer in a year |

Beyond the first $500,000 of all SP/LSP paid by an employer in a year

|

| 1-3 |

50%, capped at $3,000 |

50% |

| 4 |

55%, capped at $25,000 |

55% |

| 5 |

60%, capped at $25,000 |

60% |

| 6 |

65%, capped at $25,000 |

65% |

| 7 |

70%, capped at $50,000 |

70% |

| 8 |

75%, capped at $50,000 |

75% |

| 9 |

80%, capped at $50,000 |

80% |

| 10 |

80% |

85% |

| 11 |

80% |

90% |

| 12 |

85% |

95% |

| 13 |

85% |

100% |

| 14-19 |

90% |

100% |

| 20-25 |

95% |

100% |

What is DSA Scheme?

It is a compulsory and dedicated saving scheme to assist employers to save up to meet their future SP/LSP obligations after the abolition of the MPF offsetting arrangement. Employers are required to set up DSAs under their own name and contribute an amount equivalent to 1% of their employees’ monthly relevant income. Employers may stop making contributions to their own DSAs when the savings in their DSAs have reached 15% of the annual relevant income of all their employees.

As to whether an employer can decide on which fund to invest for the 1% contribution under DSA, and the future arrangement when full portability of MPF benefits is in force (employees can transfer all the accrued benefits of MPF mandatory contribution by their employers and themselves to the MPF scheme of their own choice), details are yet to be announced by the Government.

Can employers be exempted from making DSA contributions for certain employees?

In order not to discourage employers from making voluntary MPF contributions for their employees, employers making voluntary MPF contributions at 1% or above of the employees’ relevant income in addition to the 5% mandatory MPF contributions would be exempted from making DSA contributions. Besides, employers whose employees are currently not covered by the MPF System, including persons covered by statutory retirement schemes or provident fund schemes (e.g. civil servants or teachers of grant/subsidized schools), members enrolled in occupational retirement schemes with MPF exemption certificate, domestic employees, employees aged under 18 or aged 65 or above, etc. would also be exempted.

Are there any more details regarding the DSA Scheme?

The Government will submit another bill in the next legislative session with a view to the implementation of the DSA Scheme which aims to assist employers to save up to meet their SP/LSP obligations. The Mandatory Provident Fund Schemes Authority has built the related functionalities on the eMPF Platform to support the DSA Scheme for the Labour Department to set up DSAs for employers to handle work related to the abolition of offsetting arrangement.

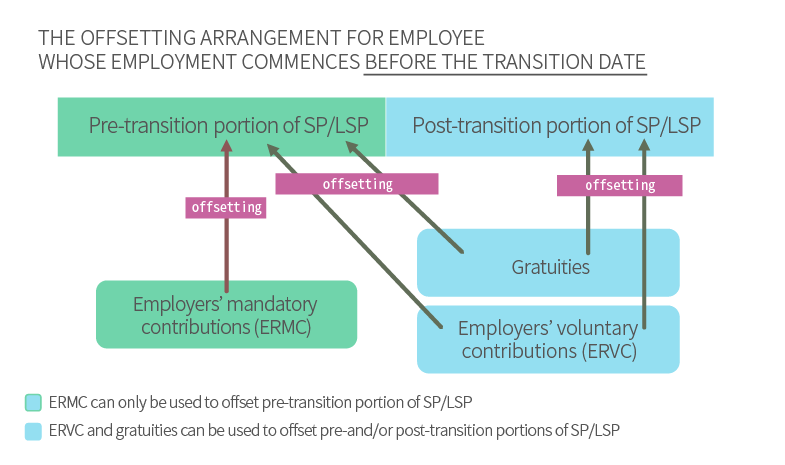

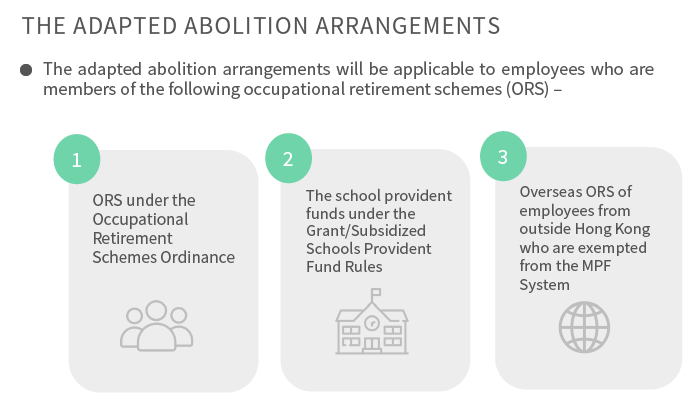

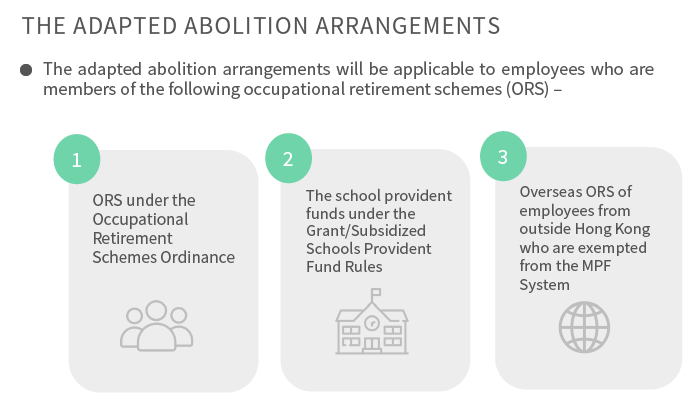

Is the offsetting arrangement applicable to members of an occupational retirement scheme?

Since the benefits under the above schemes are not differentiated into mandatory and voluntary portions, a portion of “non-offsettable” benefits* will be carved out from the ORS benefits. Calculation formula is as follows:

Final average monthly relevant income × Years of service with ORS benefits × 5% × 12

Remaining benefits after carving out the “non-offsettable” benefits (akin to employers’ voluntary MPF contributions) can offset the pre- and/or post-transition portions of SP/LSP.

*“Non-offsettable” benefits – akin to employers’ mandatory MPF contributions and can only be used to offset the pre-transition portion of SP/LSP

As to other FAQs such as the difference in the calculation of SP and LSP after the abolition of the offsetting arrangement and whether all accrued benefits derived from employers’ mandatory MPF contributions can no longer be used to offset an employee’s SP/LSP, please visit Labour Department’s official website for more details.